- Banktivity vs ynab how to#

- Banktivity vs ynab update#

- Banktivity vs ynab manual#

- Banktivity vs ynab software#

One other question: I've set this up on my Mac.

Banktivity vs ynab how to#

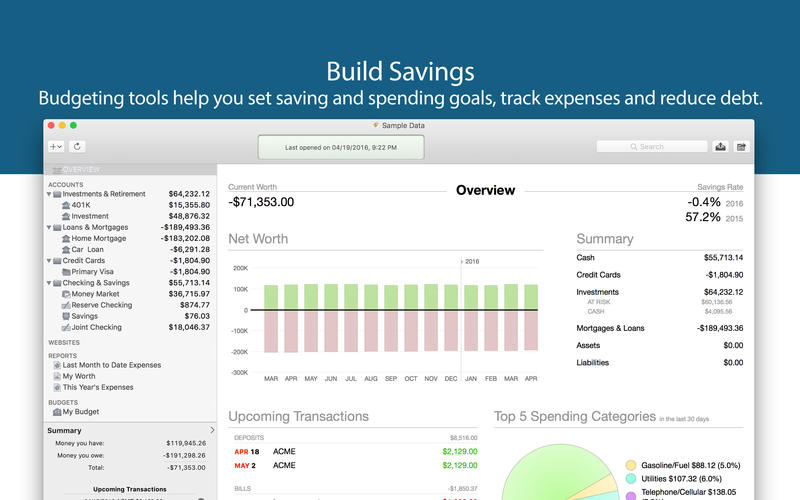

I read the explanation below about how to get all this money back into their respective envelopes but I'm not following it because I don't get it! Can someone explain a step by step process that will allow me to do this? Does that mean that I have to delete all the prior transactions from January and February? And then manually enter a starting balance that matches the checking account balance at the bank? I'm asking because I had a lot of categories in YNAB that had money in them to spend at the end of February. Still using YNAB4 in parallel, but found that the envelope budget in Banktivity covers all I need. Most transactions from downloaded but I want to start fresh as of. After more than 10 years with YNAB I personally went with Banktivity instead since it offers so much more than just the envelope budget and for a more reasonable price than nYNAB. Offers flexible budgeting, allowing you to budget your way. Limited support for automatic categorization. I'm going nuts trying to figure out through all my accounts where the discrepancy is. Simple, effective and efficient money management. Supports automatic categorization and rules, which let you automate a variety of mundane tasks. My net worth is 10 off from one to the other. Buy now 69.99 About Features What's New Reviews Compare Turns out, you need MORE than a budget.

Banktivity vs ynab software#

I also replicated my YNAB categories in Banktivity. Banktivity 7, the best personal finance software for macOS Award-winning software to help you pay off debt and grow your wealth. I set up my checking account, my savings account and 2 credit cards with direct downloads. (Again, like Moneywell, automated transaction importing was limited to certain banks, and at least back then there was no mobile app or built in syncing.) I just looked it up again and the aesthetic looks even more dated now, but it appears to still be getting updates for recent versions of Mac OS.I've read all the posts here but I'm still confused! I want to do a fresh start with Banktivity. It was clearly a windows app that was written in the late 90s and then ported to the mac (and so it has kind of a janky aesthetic) but it had a simple interface that did envelope-budgeting well. I used Budget for six or seven years in the mid 2000s before transitioning to Moneywell.

Banktivity vs ynab update#

I know there was a big update to Moneywell version 3, but I have not used that version, so maybe things have gotten better.

For example you can budget your mortgage payments and see your. Additionally, at least at that time, the syncing with the iPhone app was over a shared Dropbox file and was error prone and buggy - I ended up just basically not using the mobile app at all. Banktivitys envelope budgeting provides more visibility and detail over time than YNABs.

Banktivity vs ynab manual#

I was stuck doing manual transaction imports for some of my accounts which was kind of a pain. As I recall, Moneywell supports transaction importing through the quicken connect format, which is great if your bank/credit card supports it, but at least back then, not all of mine did. Over the years I have used Quicken, Mvelopes, YNAB and Mint. The big downsides were transaction importing and syncing between mobile and desktop. Featured in Apples New apps and games we love Banktivity 6 ushers in a new level. It’s a decent mac app and it did a good job of helping me plan my spending and track my longer-term financial goals. I used Moneywell for two or three years around 2012 and was pretty happy with it at the time. Both are offline, non-subscription, and use the same envelope budgeting paradigm as YNAB. Two options I do have experience with are Moneywell and Budget. Unfortunately, I have not experience with Moneydance or Banktivity.

0 kommentar(er)

0 kommentar(er)